|

The "Game" in Definition

by Walter Burien

08/31/07

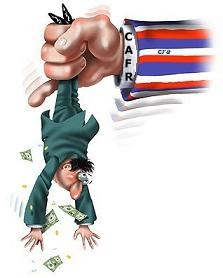

CAFR - HISTORY: It has been reported that trillions of collective dollars not shown in government Budget reports are shown through Government CAFR reports and they are virtually never openly discussed by the syndicated NEWS media, both the Democratic and Republican Party members, the House, Senate, and organized public education, and as in such over the last 50 years the domestic and international investment assets of US Federal and Local Governments as a whole have taken over the Stock, Derivative, Insurance, and Debt Markets. The collective private sector’s assets and investments as of 2000 are now insignificant in comparison with what US Government now owns by and through investment. CAFR - HISTORY: It has been reported that trillions of collective dollars not shown in government Budget reports are shown through Government CAFR reports and they are virtually never openly discussed by the syndicated NEWS media, both the Democratic and Republican Party members, the House, Senate, and organized public education, and as in such over the last 50 years the domestic and international investment assets of US Federal and Local Governments as a whole have taken over the Stock, Derivative, Insurance, and Debt Markets. The collective private sector’s assets and investments as of 2000 are now insignificant in comparison with what US Government now owns by and through investment.The CAFR is “the” accounting document for every local government, and with it being effectively “BLACKED OUT” for open mention over the last 60 years, and that this fact of intentional omission of coverage is the biggest financial conspiracy that has ever taken effect in the United States. (NOTE: It took the full cooperation of the syndicated media, organized education, and both political parties to pull it off) First, what is a CAFR? A CAFR (Comprehensive Annual Financial Report) is government’s complete accounting of “Net Worth”. The CAFR was established as local government’s complete accounting record starting in 1946 through the efforts of a private group located out of Chicago, IL by the name of Government Financial Officers Association (GFOA) http://gfoa.org and became mandatory by Federal requirement on all local governments in 1978 to complete if they did not all ready do so. What Government, both political parties, organized education, and the syndicated News media have presented to the public over that 60 year time period were Budget Reports. A Budget report is strictly planned expenditures for the year from a grouping of specific government service agencies. A budget may also note some statistical, statutory, and demographic data for reference. Most Government budget reports show where “tax” revenue will be used. The CAFR on the other hand is not a projection of one year’s expenditures from a select grouping of agencies, but a complete cumulative record of assets, investments, and gross income from all agencies and all sources benefiting or held by that local government body. A CAFR is the counter part to the Annual Financial Report (AFR) that publicly traded corporations are required to produce each year and give to every share-holder as a requirement of Securities Exchange Commission (SEC) law. In many cases, a CAFR may show two to three times more income over what is shown in the corresponding Budget Report. Relevant to taxpayer interests, the CAFR “is” the report for review over a limited showing as seen in the corresponding Budget report. The CAFR could be considered the Bible of asset accounting for any local government body. So, is the CAFR being “BLACKED OUT” from mention by the syndicated news media and both the Democratic and Republican Party members, and the House or the Senate, and even organized education? A Google search for CAFR produces over 6,500,000 hits but a Google “NEWS” search for CAFR as of 08/31/07 only produces seven (7) obscure hits of simple mention. A corresponding “NEWS” search in the archives of the New York Times, LA Times, Chicago Tribune, and Wall Street Journal, which go back in their data banks, several decades showed in combination less than seven hits for CAFR. Here with this disparity the answer for “is there a Black-Out from the Syndicated NEWS” agencies? The answer here would have to be a clear yes. Have the school districts from across the USA that educate their students on Budgets, who also produce a CAFR each year made simple and basic mention of the CAFR at any point for education of their students of this basic subject? No, they have not. Here does a Blackout exist? Apparently, yes is the answer. Have elected officials or politicians in or running for office who talk continuously about Budgets openly made mention of the greater report of their local city, county, or State the CAFR, linked them at their web sites, or linked for mention in their news letters over the last 60 years? Virtually not a peep if at all any mention. Here does a Blackout exist? Apparently, yes is the answer. Are local Government CAFRs sent to all members of the House, Senate, Editors of Local News Papers, News Networks, and Educational department heads? Yes, they have. The printing of the CAFR is a budgetary item requiring records to be kept as to each sending. The before mentioned representatives have been sent the local government CAFR reports relevant to their locale now for over 50 years. Here does a Blackout exist? Apparently, yes is the answer. Upon overall review of the question: Does a Blackout, and in fact a conspiracy exist towards bringing the CAFR into the light of day for public scrutiny. Based on the clear record over the last 50 years of abstention from the use or mention to the public, the answer here also appears to be a clear yes. From the over 84,000 CAFR reports produced by local Government each year in combination with Federal Government’s own investment holdings, shows a conservative value of sixty trillion dollars held by Local and Federal Government as of 1999. An example of the holdings shown from just one Government CAFR (NY STATE 2005 RETIREMENT FUND CAFR) shows 133 billion dollars of investments held (Microsoft 44 million shares thereof). http://cafr1.com/NYSR.html Motive for conspiracy to Blackout the simple mention of CAFR from the public’s realm of comprehension? ANSWER: The substantial money, Investments, and Power obtained there from and accomplished for those on the inside track could be the most probable answer. (But then they view us as productivity units to be managed) With productivity unit in mind, please pay special attention to the following per a SS#

For every resident (with a SS#), the State calculates how much money (direct and indirect tax revenue) that individual will generate for the State over that person's lifetime.

Here the State is projecting earned income from a productivity unit, YOU to get their IOU

A standard is $750,000 to 1.5 million dollars of tax income generated over each unit's lifetime. They then market this projected earned income of each unit as a bond or debenture in the domestic or international markets at a discount to accomplish a cash payout or in effect, a credit line today on that projected income per unit tomorrow. After sold, these instruments are traded back and forth as any other.

Prisons do the same: A prisoner is sentenced to 20 years x $89 per day x 365 x 20 = $649,700, instrument floated, cash raised today. (Hey, we need more beds, let's build another prison, and keep that a-flow of units a coming. We need to find or create some more crimes out there so we can float some more advance cash payments?)

You now also know why the hospital pushes a SS# on a parent the day a child is born.

The SS# in the small print, has it noted in so many words that; by accepting the benefits offered, you will comply with all "other" agency requirements, or the requirements / conditions of their assignees.

I bet you did not know you were so valuable from birth?

From birth, at work, or in jail, it doesn’t matter where or what stage of life you are in, your unit value will be marketed to the highest bidder for their and the State's profit. Hey, I thought they outlawed slavery in this country a century or so ago. Oh yea, I forgot the equal opportunity and civil rights amendments. Never mind, in light of when you let the foxes write the laws on how many hens can be eaten from the hen house look what happens!

PS: On a last note, take a look at: http://CAFR1.com/PA.html

Now try and have a good life! Really. (It can be done with a little effort, and we can do it!)

.

The corporate government "Machine" needs a few modifications!

.

Yours truly,

Walter J. Burien, Jr. |